*LATEST* Arminius Capital hedge fund “ALPS” generates positive Chinese coronavirus returns

The Arminius Capital ALPS Fund returned +1.11% for February 2020, building on its +1.38% of January.

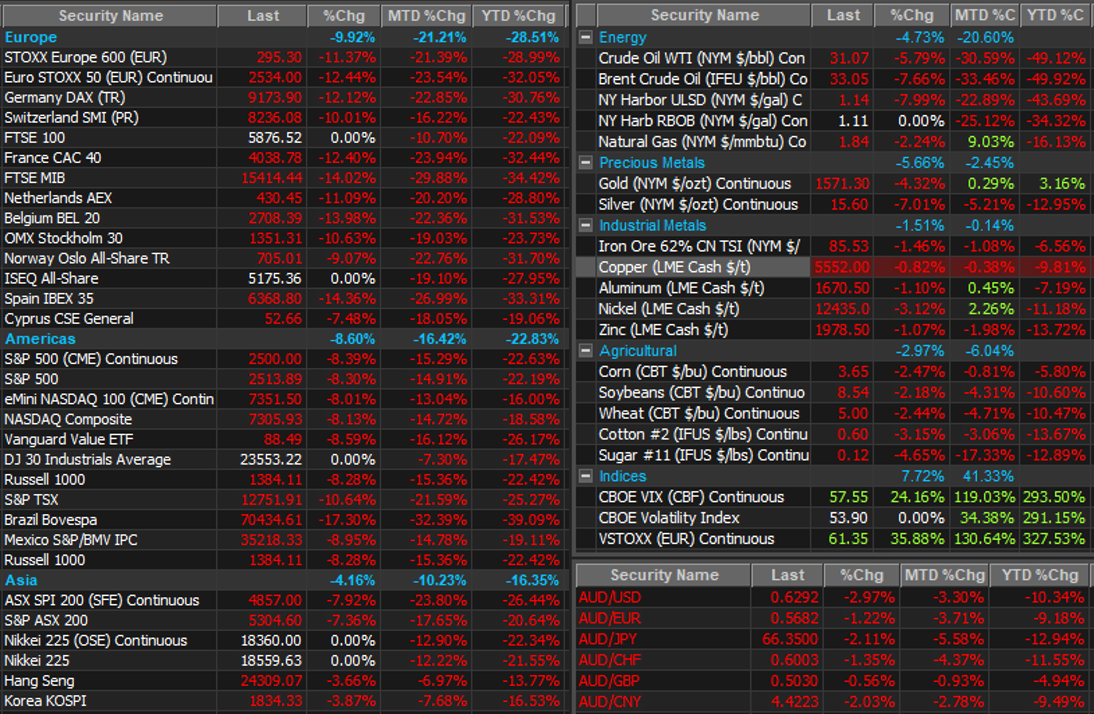

All major markets fell in February 2020: S&P500 -8.41%, Eurostoxx 600 -8.54%, NIKKEI -8.89%.

To the end of February, the Arminius Capital ALPS Fund has returned +2.51% YTD 2020.

(YTD 2020: S&P500 -8.56%, Eurostoxx 600 -9.66%, NIKKEI -10.63%).

Although we are only 12 days into March, most global markets have suffered terribly, ending the 11 year bull market in equities. Both energy commodities and global equities have commenced their march into a bear market.

However, we are pleased to report that the Arminius Capital ALPS Fund has generated POSITIVE RETURNS in March (as of month-to-date data as at 12th March 2020).

GLOBAL MARKETS PERFORMANCE: MTD % Chg is to 12 March 2020

The February 2020 Performance Report is currently being finalized and will be published shortly. Please check back here for it: https://arminiuscapital.com.au/funds/ . Subscribers to the Arminius Capital ALPS Fund reports will receive it automatically to their inbox when it is published. Subscriptions can be managed in the footer section on our homepage https://arminiuscapital.com.au/

We will provide you with more market updates in coming days.

Kind regards

Marcel.

Marcel von Pfyffer

Managing Director